Zora Exploration #2: How does the protocol actually work?

Exploration into Automated Market Makers and Zora's Protocol design (at a high level)

In the last piece I wrote about how Zora flips the idea of social media on its head. Every post is not just content, it is also a market. That sounds exciting, but whenever I tell my friends about Zora, they have a lot of questions. How does it actually work? Where does the liquidity come from? Why doesn’t it dry up? And what happens if everyone buys or sells at once?

Honestly, I realized that I had some gaps in my knowledge, so did some exploration of my own.

Here’s what I learned.

The Building Blocks

Zora has two kinds of tokens. First are creator coins. These are like your personal currency, backed by the ZORA token itself. Second are post coins. Every time you make a post, the system spins up a brand new token for that post.

To make sure the market is alive from the start, the system gives the creator a small slice of the supply right away, while the rest goes into a trading pool. That means when someone sees a new post they don’t just see content, they see an active market they can participate in immediately.

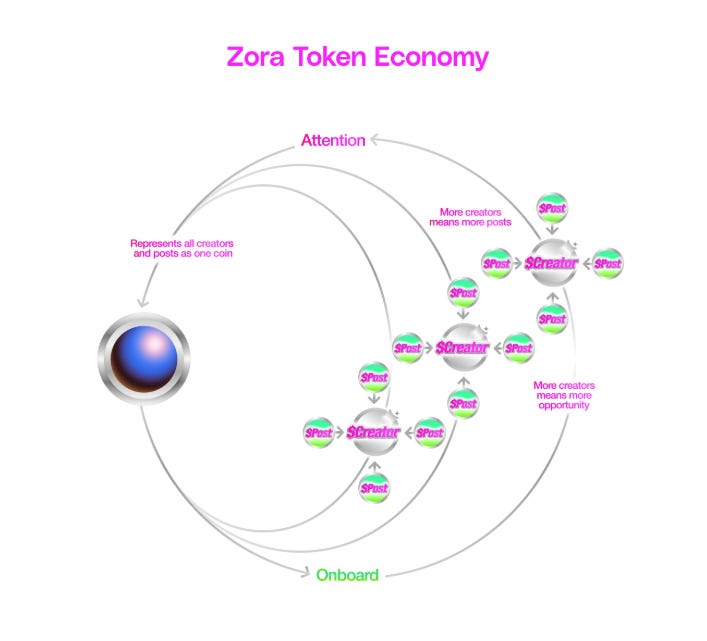

These tokens are connected in a ladder. Post coins trade against creator coins, and creator coins trade against ZORA. Through ZORA you can reach ETH or USDC. It all links together so that anyone can get in or out without worrying about holding a specific coin already.

Figure 1: High level overview of the Zora Token Economy Source: Zora

Trading Without Buyers

Traditional markets need a buyer and seller to meet. Zora does not. It uses something called an Automated Market Maker, or AMM. The idea is simple. Instead of an order book, there is a pool of two tokens. Anyone can swap with the pool.

The pool follows a rule: the balance of token A multiplied by the balance of token B always equals the same number. If you add one token to the pool, you take some of the other token out. The ratio shifts, and the price changes automatically.

I found this a little confusing. So here’s a simple example, that hopefully explains a bit more clearly. Imagine a pool starts with 100 creator coins and 100 post coins. At this moment, one post coin is worth one creator coin. If someone buys 10 post coins, they put creator coins into the pool and take post coins out. Now there might be 110 creator coins and 90 post coins. The ratio is different, so the price has moved. Post coins are now more expensive than before.

Because of this formula, the pool never fully runs out of tokens. If you try to buy the very last post coin, the price shoots up toward infinity. In practice that means the market is always alive, but it can get expensive to trade when supply is thin.

Think of it like a vending machine that raises the price a little every time someone buys a bag of chips. The last bag is never gone, it is just insanely costly.

Where Liquidity Comes From

There are three main ways liquidity shows up in these pools.

First, Zora itself seeds a starter balance when a new coin is created. That way there is something to trade against from day one.

Second, anyone can add more liquidity to the pool. If you put in equal amounts of both tokens, you become a liquidity provider. In return you earn a share of fees from everyone who trades.

Third, and most interesting, Zora locks a slice of every trade fee back into the pool. This means that over time the pool only gets deeper. Activity does not drain the market. It strengthens it.

That last point is a big shift. In Web2, a post is valuable for a few hours in the feed before it fades into the background. On Zora, every trade in a post coin actually reinforces the market for that post. Instead of fragility, you get compounding strength.

Why This Matters

In Web2, creators rely on ads, platforms, or sponsorships. They do not control the market for their work. Zora flips that. Every creator has their own economy. Every post has a self-sustaining market.

The best way to think about is that it is about building markets directly into culture. Content does not just generate engagement. It generates liquidity and market for people to buy and sell, that benefits both fans and creators.